TiO₂ INSIDER

By Gerald Colamarino, Director, TiPMC Solutions, Wilmington, DE

China’s Changing Position in the Post-Pandemic World

Video: Xiaoxing Zhao / Creatas Video, via Getty Images

The TiO₂ industry is quickly returning to strength, as 4Q20 YoY volumes were significantly higher. Nowhere is the impact more immediately felt than China, as both the domestic market and the export market are seeing rapid gains in price. TiO₂ pricing is up an estimated 35% since early September for Chinese pigment. What is behind the increases, and why does it not represent significant earnings improvement for Chinese companies?

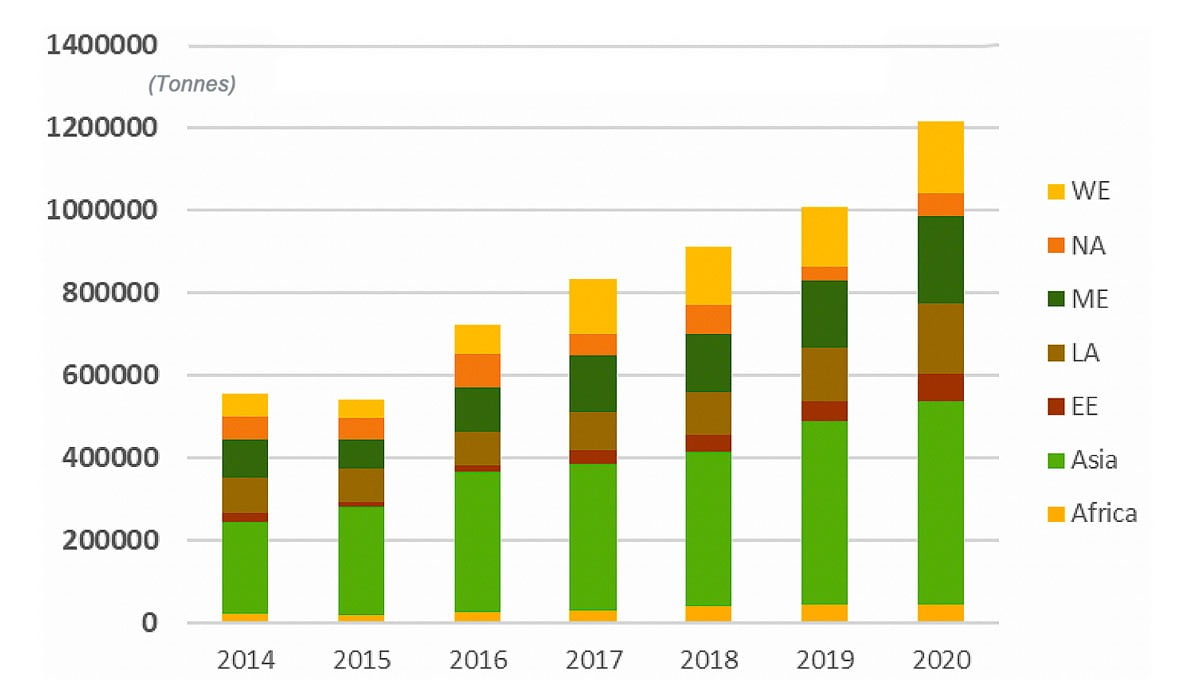

A brief history of China’s recent past provides some insight. China has continued to expand its exports in 2020, doubling its TiO₂ exports since 2015, reaching over 1.2M tonnes in 2020.

FIGURE 1 ǀ 2014-2020: Chinese exports

Source: Global Trade Tracker

TiPMC estimates that TiO₂ growth within China to be between 4-5% in the same period, or roughly 400ktpa. Although some capacity has been added, most production has come from improved utilization rates. Chinese TiO₂ producers have been notorious for operating capabilities well below their nameplate capacity. This has improved dramatically, recently reaching the tipping point, to where producers have a level of sustainable pricing power.

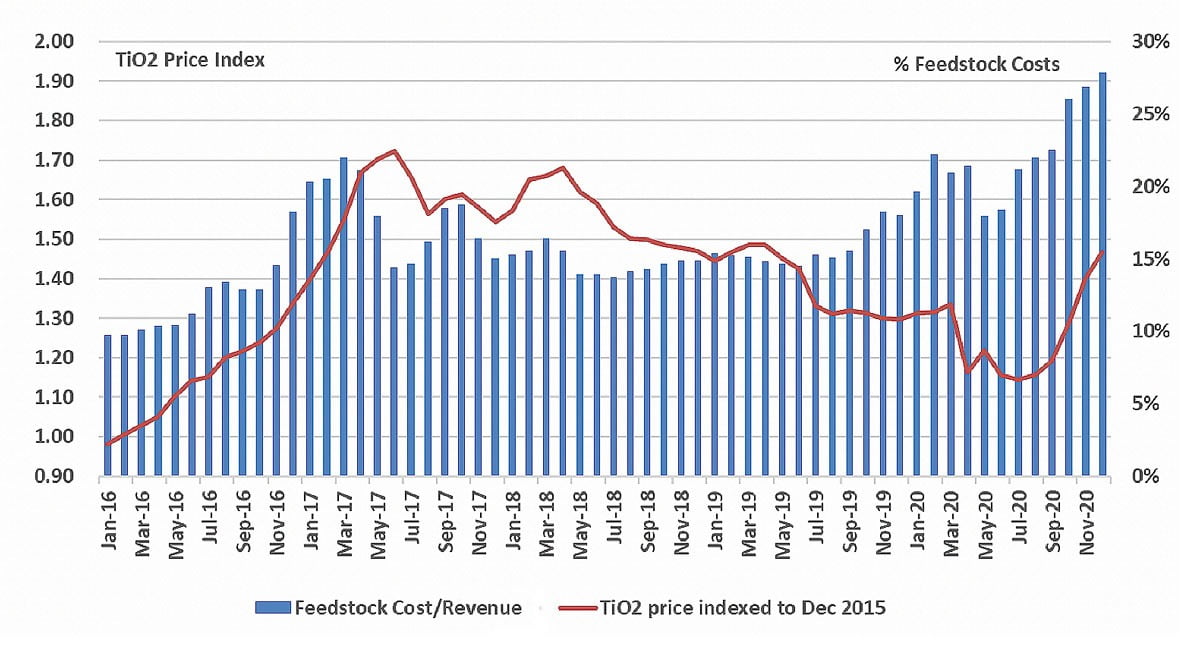

Despite recent price gains, Chinese producers are still not near their peak pricing of early 2017, when environmental enforcement severely impacted production. The recent price increases have come after years of decreasing prices in favor of volume. Adding to the margin pressure is an increase in costs. Producing 1M tonnes of TIO₂ requires over 2M tonnes of ilmenite, the primary source of TiO₂ feedstock for Chinese producers.

The once favorable ilmenite supply/demand dynamics have led to a tight supply situation, lending itself to significant increased costs to Chinese producers. New ilmenite production has been limited, and mines are depleted or have been shut down over this period. Given increases in other costs such as labor, energy and most recently transportation, Chinese producers are still struggling with earnings margins despite the recent price increases.

FIGURE 2 ǀ 2016-2020: Chinese margin depletion.

Source: Ferroalloynet and TiPMC Estimates

How are Global Producers Responding?

Value and margin stabilization initiatives had created a large gap in pricing between Chinese and global producers, at a cost of market share. The gap is quickly shrinking. As the gap in pricing closes, customers are more inclined to purchase material from global suppliers, with better performance and supply reliability. Alternatives, such as other regional suppliers and trading companies, offer inconsistent product and supply risk, which is unacceptable to many consumers, given the increase in their businesses as the world recovers from COVID-19.

As expected, Chinese producers are announcing capacity increases. The total announcements add up to approximately 1.7-1.8M tonnes. Given over 1M tonnes are new chloride producers, the near-term reality of quality pigment production from new Chinese sources is in question. Sulfate expansions may be limited by sustainable margins and product acceptance, as product quality becomes an issue for expanding market share.

The outlook is positive for most TiO₂ producers for 2021. Increasing demand and the limited ability of Chinese producers to respond fairs well for global players. Multiple factors, including feedstock, Chinese chloride capabilities and product quality all will impact the long-term future of the industry.

For more insights into the TiO₂ and Mineral Sands markets, visit TiPMCconsulting.com. See our ad in this issue for more details. For more information about the impact of COVID-19 on the TiO₂ industry, ask to see our latest issues.